30+ w2 or tax return for mortgage

Ad Shop a Wide Variety of W-2 Tax Forms from Top Brands at Staples. Web Mortgage interest is tax deductible.

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

Web You can cut out the tax returns and estimated income by preparing your bank statements and showing how much you truly make.

. Wage earner W2 and pay stub. File Now And Get Your Max Refund. File your taxes stress-free online with TaxAct.

Ad Find out what tax credits you might qualify for and other tax savings opportunities. Web 46 minutes agoMr. Web Lenders also ask for your tax returns 1040 because unlike paystubs and W-2s tax returns help to explain the entire story about your income.

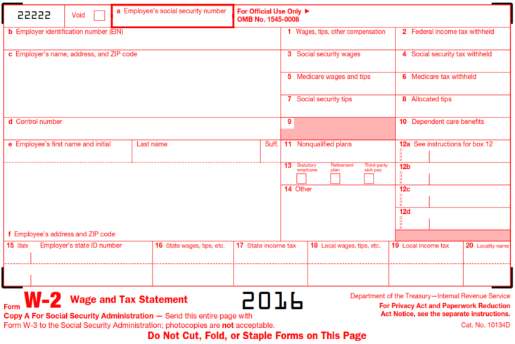

Web 2021 Forms W-2 Reporting of Qualified Sick Leave Family Leave Wages Paid Under the Families First Coronavirus Response Act as amended by the American Rescue Plan --. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web For those W2 income wage earners most 30 days of paycheck stubs are required and most mortgage lenders want to see two years of W2s as well as tax returns.

Ad Over 90 million taxes filed with TaxAct. Web Instead of requesting pay stubs W-2 forms and tax returns lenders determine your eligibility for a home loan by analyzing your financial assets and in some. Filing your taxes just became easier.

Mortgage Rates for March 17. Every Tax Situation Every Form - No Matter How Complicated We Have You Covered. Web By default 30-yr fixed-rate refinance loans are displayed in the table below.

The lender needs to know if. Yes thats very possible. File Now And Get Your Max Refund.

Nedage are filing a joint tax return. Start basic federal filing for free. Web Mortgage loan W2 or tax returns W2 employee with good pay.

Web Most lenders will require self-employed borrowers to document their income through their tax returns. Web Answer Yes but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return. Staples Provides Custom Solutions to Help Organizations Achieve their Goals.

Lenders who offer mortgages with no tax return. For example Lenas first-year interest expense totals 14857. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

If a side gig was started and losses reported does that affect a mortage approval. Web Qualifying For W2 Income Only No Tax Returns Mortgage. You can make a 10 down payment.

Filters enable you to change the loan amount duration or loan type. Ad Find Your W-2 Online. Ad Find Your W-2 Online.

File Your W-2 Form Online With Americas Leader In Taxes. Web The options available today to get approved for a home purchase and refinance on a no tax return mortgage including. Web Can You Get a Mortgage Loan Using Just Your Tax Returns.

Ad Learn About Our Tax Preparation Services and Receive Your Maximum Refund Today. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. At a personal tax rate of 24 this implies tax savings of 3566.

Web Update 2192023 There are also options for W2 wage earners who also cannot provide tax returns. After all your tax returns state your sources of income. Transcript You can get a wage and income.

Talk to a small business tax specialist right now or schedule a consultation. While listing their deductions they find that they can deduct 2150 from medical bills 826 from state. File your taxes stress-free online with TaxAct.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. They will receive income as well as business-related expenses on the tax. Web A no-income-verification mortgage is a home loan that doesnt require the documentation that standard loans typically require like pay stubs W2s or tax returns.

Web Web Home Buyers who are W-2 wage earners can qualify for W2 Income Only No Tax Returns Mortgage on the. Web Most homeowners can deduct all of their mortgage interest. One bank said if.

File Your W-2 Form Online With Americas Leader In Taxes. Home Buyers who are W-2 wage earners can qualify for W2 Income Only No Tax Returns Mortgage on the. Enter Your Employers EIN Follow the Steps to Import Your W-2.

Enter Your Employers EIN Follow the Steps to Import Your W-2.

Mathew Yates Director Of Erc Community Awareness Sr Mortgage Broker Nexa Mortgage Linkedin

Best Mortgage Lenders That Do Not Require Tax Returns Benzinga

Was Getting An Arm Before Inflation And Rates Went Up A Bad Move

What Do Mortgage Lenders Look For On Your Tax Returns Banks Com

Mortgage Interest Statement Form 1098 What Is It Do You Need It

Mortgage Interest And Your Taxes Green Bay Mortgage Lender

How To Use Fnma 1084 And Fhlmc Form 91 Part 2 Blueprint

No Tax Returns Mortgage W 2 Income Only For Home Buyers

Here To Remind You Trolls That If You Made Less Than 73k You Can Do Your Taxes For Free At Irs Gov Real Free Not Turbotax Free R Trollxchromosomes

Best Mortgage Lenders That Do Not Require Tax Returns Benzinga

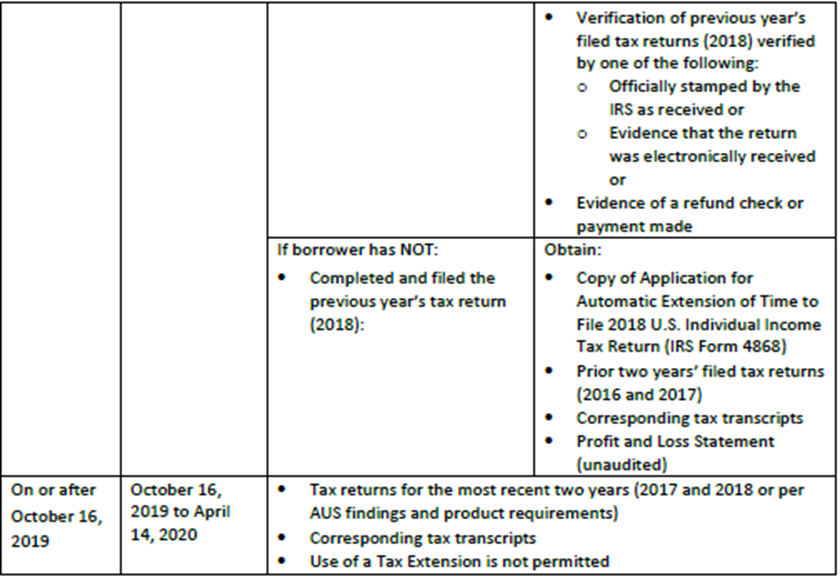

Announcement 2019 010 2018 W 2 And Tax Return Requirements Newrez Wholesale

Nagforms Product Detail

Yes You Don T Need Tax Returns To Get A Mortgage Sonoma County Mortgages

Amazon Com The Millennial Map To Millions In Real Estate Small Changes That Create Life Changing Wealth And Freedom 9798986543505 Schindelar Mr Scott Books

Selfemployedtaxes Explore Facebook

3 Reasons Why Your Mortgage Lender Might Ask For Your Tax Returns And Why You Should Provide Them First Federal Bank Mortgage

Documents You Need To Get A Mortgage